The upcoming shift to mandatory e-invoicing within the EU: What you need to know

New regulations are coming to EU businesses. Soon, you will be required to transition from traditional invoicing methods to electronic invoicing (e-invoicing) to be compliant with EN 16931. This change aims to standardize and streamline financial operations across the union. The digitalization shift promotes efficiency and transparency in B2B and B2G transactions.

If you’re a Rentman user, don’t worry! Rentman’s invoicing capabilities already meet these new standards, meaning you won't be impacted by this change.

1. What is an e-invoice?

2. Benefits of e-invoices

3. The new e-invoicing regulation across the EU

4. Rentman’s e-invoicing capabilities

What is an e-invoice?

According to Directive 2014/55/EU of the European Parliament and of the Council of 16 April 2014, an e-invoice is a structured digital file that can be automatically processed by the recipient’s accounting software, making it distinct from both paper and PDF invoices. It’s crucial to recognize the differences between the three main types of invoices:

- Paper Invoice: The most traditional form of invoicing, involves physically printing an invoice. Paper invoices are time-inefficient and prone to errors.

- PDF Invoice: A PDF invoice is an electronic version of a paper invoice. Even if it’s easier and faster to create than paper invoices, it’s still unstructured data, meaning that it must be manually entered into accounting systems.

- E-Invoice: E-invoices are fully digital and structured, often in formats like XML or UBL. These formats allow for direct integration with accounting software, automating the entry and processing of invoice data. E-invoices are far more efficient, significantly reducing manual work and the potential for errors.

Benefits of e-invoices

Switching to e-invoices provides considerable advantages, such as:

- Automation: Since e-invoices are machine-readable, they can be directly imported into accounting systems, reducing the need for manual data entry.

- Accuracy: E-invoices lower the risk of human error.

- Faster processing: Automation also speeds up the invoicing process, meaning quicker payments from your customers.

- Cost efficiency: E-invoices eliminate the need for printing, postage, and manual handling, resulting in significant cost savings.

- Regulation compliance: E-invoices meet the upcoming legal and tax requirements, ensuring businesses will remain compliant once the new changes are mandatory.

The new e-invoicing regulation across the EU

The move towards e-invoicing is part of an ongoing effort to modernize the tax and financial infrastructure and will ensure more transparent cross-border trade within the EU. The upcoming regulation will require businesses to issue only e-invoices in structured formats, such as XML or UBL. Some countries, such as Germany, will already impose this change starting from January 1st, 2025.

This will apply to both B2B (business-to-business) and B2G (business-to-government) transactions, to make transactions more transparent, reduce tax evasion, and improve overall efficiency in financial processes.

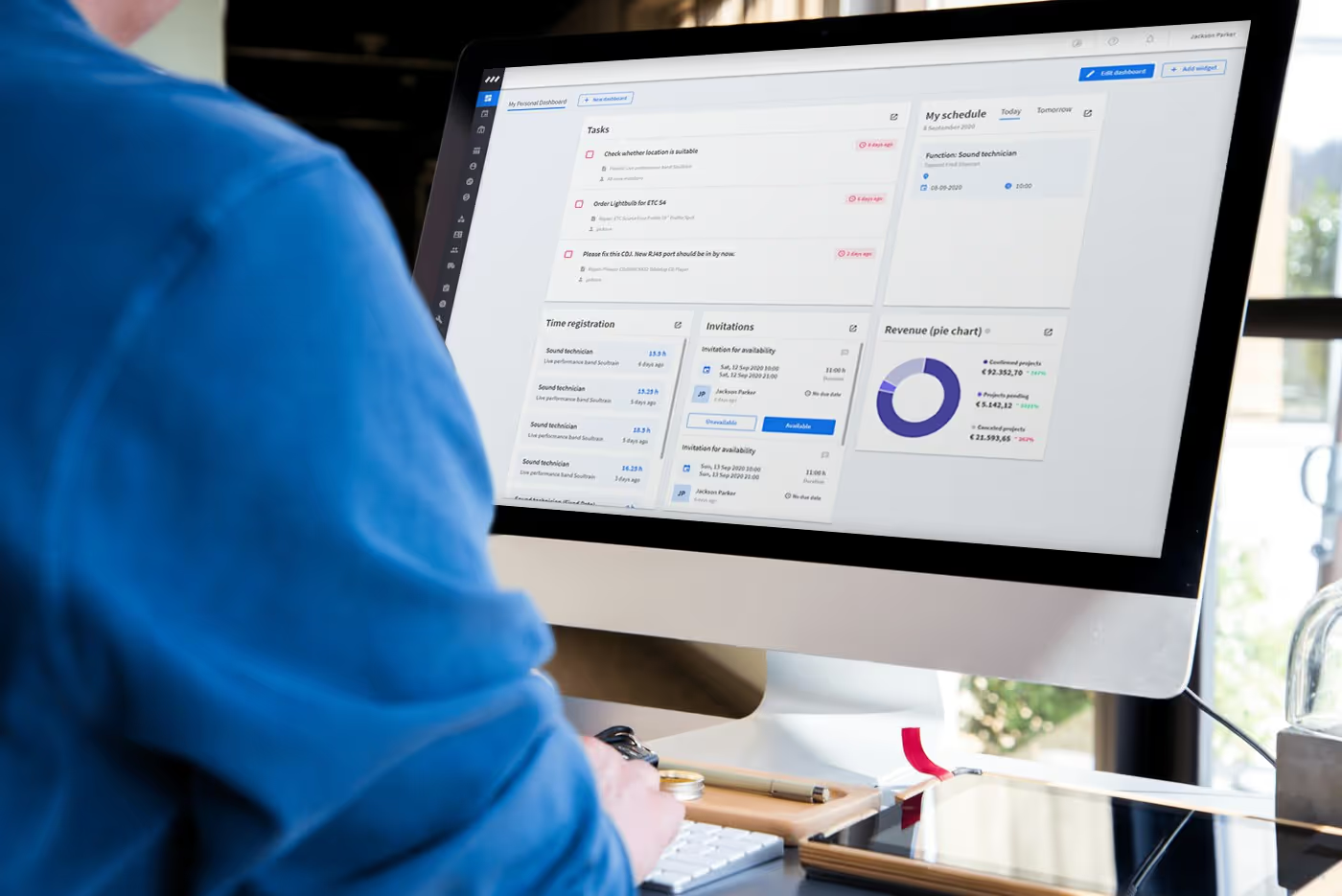

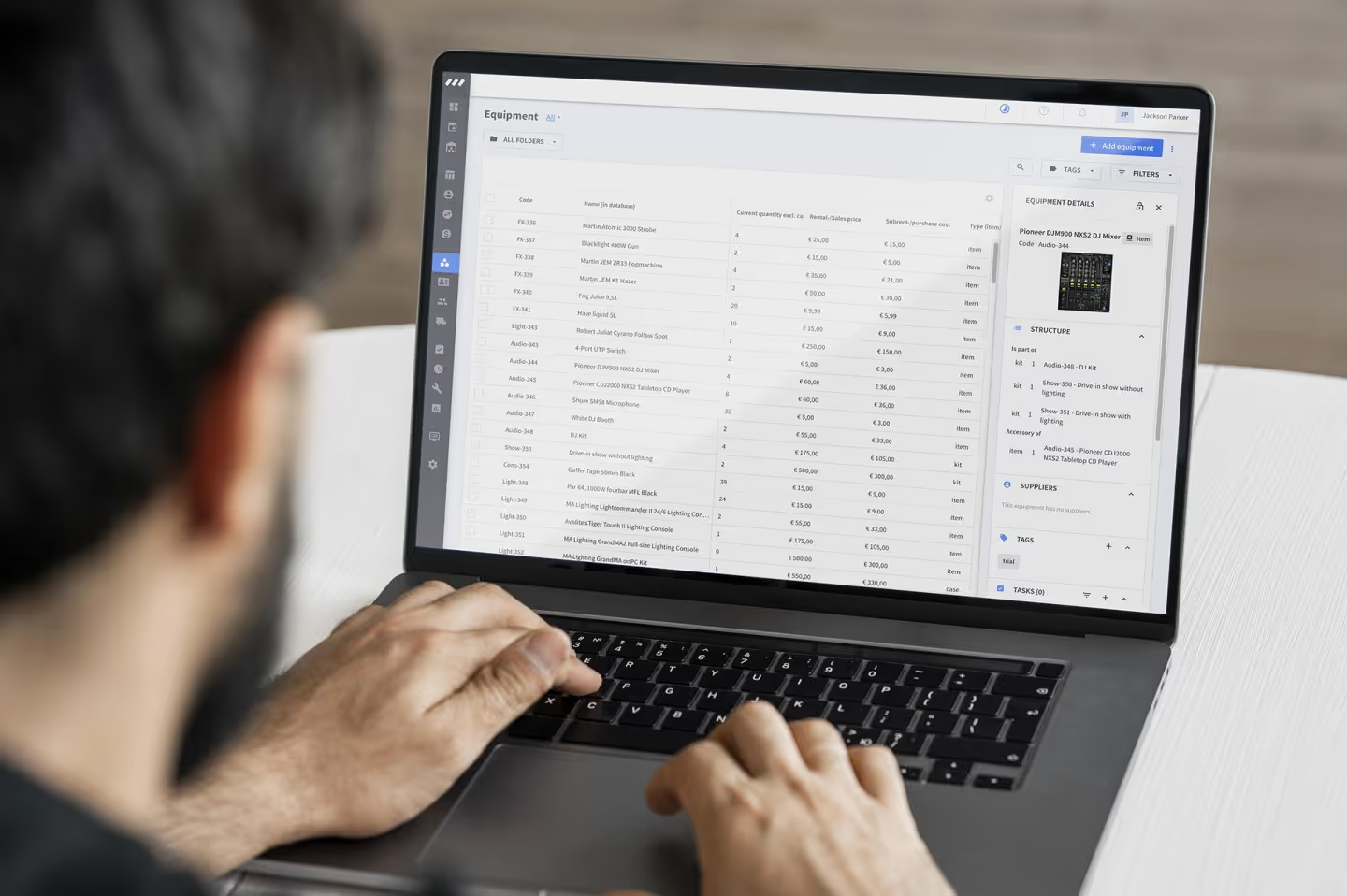

Rentman’s e-invoicing capabilities

If you're a Rentman user, you're already ahead of the game. Rentman supports the export of invoices in both XML and UBL formats, two of the most common and widely accepted e-invoicing standards. These formats ensure that your invoices are structured in a way that can be easily processed by your clients' accounting systems.

Here's a quick overview of how Rentman supports e-invoicing:

- XML export: Rentman allows you to export invoices as XML files, a format designed to be read by computers, ensuring fast and error-free processing.

- UBL export: The UBL format is widely recognized in the EU and supports all the necessary data fields for automated processing. Rentman’s UBL invoices are fully compliant with international e-invoicing standards, making them ideal for cross-border transactions.

For more detailed instructions on how to export invoices as XML or UBL in Rentman, check out this support article.

Frequently asked questions

Previous blog posts

The Ultimate Guide to Choosing the Right Rental Company Software for Your Event Business

The Ultimate Guide to Choosing the Right Rental Company Software for Your Event Business

The Ultimate Guide to Choosing the Best Rental Business Software for the Event Industry

The Ultimate Guide to Choosing the Best Rental Business Software for the Event Industry